$1,420 Gold: Headed for a Crash?

November 19, 2010 at 4:30 pm | Posted in -- Ken's Predictions, Black Friday, CFTC, FINRA, gold price, James Fisk, Jay Gould, New York Gold Exchange, NFA (National Futures Association), SEC, Wall Street | Leave a commentThis month, November 2010, saw the nominal price of gold blast itself into the record books with a historic new high of $1,420 per ounce, almost triple the price a decade ago. It’s been a remarkable run. Too good to be true?

Before gold bugs get too giddy, it’s worth remembering that this year also marks another anniversary, the 141st, of the darkest day ever in American gold trading: Black Friday (September 24) 1869, when the notorious corner by Jay Gould and Jim Fisk climaxed in a spectacular crash that crippled Wall Street for months, bankrupting thousands, freezing the national economy, and spewing scandal to the very door of the White House. It caused an estimated $100 million in financial value to vanish in a wink, worth multiple billions in modern money.

Here’s a sketch of the floor of the New York Gold Exchange floor from that day:

Black Friday was not the only great gold market crash in US history. In January 1980, after spiking to $850 per ounce (about $2,100 in modern dollars, still the inflation-adjusted record), gold lost $200 in two days, dropping to $480, half its peak value, by March. It would take some 30 years to recoup the loss.

Black Friday was not the only great gold market crash in US history. In January 1980, after spiking to $850 per ounce (about $2,100 in modern dollars, still the inflation-adjusted record), gold lost $200 in two days, dropping to $480, half its peak value, by March. It would take some 30 years to recoup the loss.

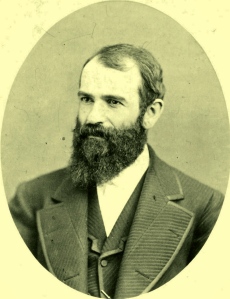

Still, 1869’s Black Friday was the ugliest, partly because both the price run-up and crash that year stemmed from the unabashed, garish actions two greedy speculators trying to enrich themselves at the expense of everyone else: James Fisk Jr. (below, left, in his ersatz “Admiral” uniform) and Jay Gould (below, right).

Fisk and Gould pulled off their famous gold corner decades before the battery of modern US financial regulators came on the scene: the SEC, CFTC, Federal Reserve, bank overseers, and even industry self-policing groups like FINRA or NFA. Fisk and Gould lost fortunes when the corner collapsed: Even back in 1869, the market was bigger than any two players, though it took the combined weight of the US Treasury announcing emergency gold sales and a pool of big banks dumping gold on the market to break their stranglehold.

Regulators can help, but commodities are notorious for volatility. Just two years ago, for instance, in 2008, we saw the price of a barrel of crude oil drop from nearly $150 in July to less than $34 in December, a whopping 75% loss, part of a sector-wide reversal.

My Prediction: Dow Jones bottom at 6,437.

February 23, 2009 at 9:01 pm | Posted in -- Ken's Predictions, Alan Greenspan | Leave a comment Move over, Market Gurus and Wall Street Know-It-Alls. I have figured this out. The end is near.

Move over, Market Gurus and Wall Street Know-It-Alls. I have figured this out. The end is near.

Greenspan’s “irrational exuberance” phrase became an instant hit, an icon, perhaps the single most repeated two-word quote of the decade. But the Dow Jones Average laughed in his face. It proceeded to jolt above 7,000 in 1997, then 10,000 in 1999, and finally 14,000 in October 2007. After the 2000-2001 Dot-Com bust, Greenspan himself seemed to forget earlier caution, pumping mass dosses of liquidity into housing and preaching tax cuts and deregulation with abandon– causing him last October to admit “mistakes” that helped spark the recent crisis.

But the irony was this: Greenspan had gotten it right the first time. The stock market in 1996 was a bubble ready to burst, as it was again in 2000, as it was again in 2007. The “exuberance” behind it was, in fact, “irrational.”

Markets have a way of avenging themselves. And if irony is indeed its guiding principle, then this one today is not going to free us from its bear grip until it forces us to relive the lession of December 5, 1996. Only when the Dow Jones Average touches that magic number, 6,437, will the curse be broken. At that point, “irrational exuberance ” officially dies, to be replaced by “irrational pessimism” — time for the bulls to return.

The end is near. Science is science. Greenspan was right. Sorry if this is bad news. Have some coffee.

Create a free website or blog at WordPress.com.

Entries and comments feeds.