Guest Blogger: Jim Robenalt on how HBO’s Broadwalk Empire flubbed its take on President Warren G. Harding

November 30, 2010 at 6:25 pm | Posted in Eugene Debs, Jim Robenalt, The Harding Affair, Warren G. Harding | Leave a commentHarding’s relationship with Nan Britton is questionable. His relationship with a woman named Carrie Phillips is not. My book, The Harding Affair, discloses Harding’s complex relationship with Mrs. Phillips through the use of over 900 pages of letters Harding wrote to Phillips from 1910 though 1920, when he was elected President of the United States. Phillips and Harding were caught in an age when divorce was unthinkable and there were multifaceted reasons for their long-term (15 year) affair. The affair was much too complicated to caulk it up sheer womanizing.

The Britton allegations are subject to real doubt, as I point out in my book. Ms. Britton lived directly behind Carrie Phillips’s home in Marion, and there is good reason to believe her book, The President’s Daughter, came from her familiarity with the Harding/Phillips correspondence and not because of any real relationship between then-Senator Harding and Ms. Britton.

The HBO series relies on biographies that falsely used the Phillips correspondence. Worse, letters Mr. Harding wrote to Mrs. Phillips are used to manufacture dialogue for Ms. Britton’s character.

But sadly for history, these smears of President Harding distort what he did as President and as a U. S. Senator. Harding was no “imbecile,” as Nucky Thompson, the main character in the HBO series, calls him. As a Senator, Harding courageously stood against Woodrow Wilson’s call for America to go to war to “make the world safe for democracy,” though he did vote for war. In a lesson America never learned, Harding warned that it is not the business of the United States to engage in regime change through the violence of war.

But sadly for history, these smears of President Harding distort what he did as President and as a U. S. Senator. Harding was no “imbecile,” as Nucky Thompson, the main character in the HBO series, calls him. As a Senator, Harding courageously stood against Woodrow Wilson’s call for America to go to war to “make the world safe for democracy,” though he did vote for war. In a lesson America never learned, Harding warned that it is not the business of the United States to engage in regime change through the violence of war.

During his presidency, Harding pardoned Socialist Eugene Debs, who was rotting in an Atlanta prison, sent there by the Wilson Administration for violating the Espionage and Sedition Act.

Debs’ crime? He spoke out against the war—that is, he exercised his right of free speech. Wilson denied a pardon even after the war ended. Harding granted it.

Who is the “imbecile”?

Entertainment is entertainment. But playing fast and loose with serious historical figures only diminishes our true understanding of history’s lessons.

For a more, see http://thehardingaffair.com/.

Jim Robenalt, a lawyer and writer in Cleveland, Ohio, is author both of The Harding Affair and his other terrific book, Linking Rings, William W. Durbin, the Magic and Mystery of America.

$1,420 Gold: Headed for a Crash?

November 24, 2010 at 9:47 pm | Posted in Uncategorized | Leave a commentThis month, November 2010, saw the nominal price of gold blast itself into the record books with a historic new high of $1,420 per ounce, almost triple the price a decade ago. It’s been a remarkable run. Too good to be true?

Before gold bugs get too giddy, it’s worth remembering that this year also marks another anniversary, the 141st, of the darkest day ever in American gold trading: Black Friday (September 24) 1869, when the notorious corner by Jay Gould and Jim Fisk climaxed in a spectacular crash that crippled Wall Street for months, bankrupting thousands, freezing the national economy, and spewing scandal to the very door of the White House. It caused an estimated $100 million in financial value to vanish in a wink, worth multiple billions in modern money.

Still, 1869’s Black Friday was the ugliest, partly because both the price run-up and crash that year stemmed from the unabashed, garish actions two greedy speculators trying to enrich themselves at the expense of everyone else: James Fisk Jr. (below, left, in his ersatz “Admiral” uniform) and Jay Gould (below, right).

Fisk and Gould pulled off their famous gold corner decades before the battery of modern US financial regulators came on the scene: the SEC, CFTC, Federal Reserve, bank overseers, and even industry self-policing groups like FINRA or NFA. Fisk and Gould lost fortunes when the corner collapsed: Even back in 1869, the market was bigger than any two players, though it took the combined weight of the US Treasury announcing emergency gold sales and a pool of big banks dumping gold on the market to break their stranglehold.

Regulators can help, but commodities are notorious for volatility. Just two years ago, for instance, in 2008, we saw the price of a barrel of crude oil drop from nearly $150 in July to less than $34 in December, a whopping 75% loss, part of a sector-wide reversal.

Hello world!

November 24, 2010 at 9:31 pm | Posted in Uncategorized | 1 CommentWelcome to WordPress.com. This is your first post. Edit or delete it and start blogging!

$1,420 Gold: Headed for a Crash?

November 19, 2010 at 4:30 pm | Posted in -- Ken's Predictions, Black Friday, CFTC, FINRA, gold price, James Fisk, Jay Gould, New York Gold Exchange, NFA (National Futures Association), SEC, Wall Street | Leave a commentThis month, November 2010, saw the nominal price of gold blast itself into the record books with a historic new high of $1,420 per ounce, almost triple the price a decade ago. It’s been a remarkable run. Too good to be true?

Before gold bugs get too giddy, it’s worth remembering that this year also marks another anniversary, the 141st, of the darkest day ever in American gold trading: Black Friday (September 24) 1869, when the notorious corner by Jay Gould and Jim Fisk climaxed in a spectacular crash that crippled Wall Street for months, bankrupting thousands, freezing the national economy, and spewing scandal to the very door of the White House. It caused an estimated $100 million in financial value to vanish in a wink, worth multiple billions in modern money.

Here’s a sketch of the floor of the New York Gold Exchange floor from that day:

Black Friday was not the only great gold market crash in US history. In January 1980, after spiking to $850 per ounce (about $2,100 in modern dollars, still the inflation-adjusted record), gold lost $200 in two days, dropping to $480, half its peak value, by March. It would take some 30 years to recoup the loss.

Black Friday was not the only great gold market crash in US history. In January 1980, after spiking to $850 per ounce (about $2,100 in modern dollars, still the inflation-adjusted record), gold lost $200 in two days, dropping to $480, half its peak value, by March. It would take some 30 years to recoup the loss.

Still, 1869’s Black Friday was the ugliest, partly because both the price run-up and crash that year stemmed from the unabashed, garish actions two greedy speculators trying to enrich themselves at the expense of everyone else: James Fisk Jr. (below, left, in his ersatz “Admiral” uniform) and Jay Gould (below, right).

Fisk and Gould pulled off their famous gold corner decades before the battery of modern US financial regulators came on the scene: the SEC, CFTC, Federal Reserve, bank overseers, and even industry self-policing groups like FINRA or NFA. Fisk and Gould lost fortunes when the corner collapsed: Even back in 1869, the market was bigger than any two players, though it took the combined weight of the US Treasury announcing emergency gold sales and a pool of big banks dumping gold on the market to break their stranglehold.

Regulators can help, but commodities are notorious for volatility. Just two years ago, for instance, in 2008, we saw the price of a barrel of crude oil drop from nearly $150 in July to less than $34 in December, a whopping 75% loss, part of a sector-wide reversal.

Joe Cannon: A Few More Images

November 18, 2010 at 2:23 am | Posted in -- CARTOONS AND CARTOONISTS, Clifford Berryman, Joseph G. Cannon | Leave a commentA few days ago, I mentioned Joseph G. Cannon, Speaker of the US House of Representatives (1903 to 1911), namesake of today’s Cannon House Office Building in Washington, D.C., who served fifty years in Congress (a record back then) and was the only Speaker ever to be stripped of powers in a public revolt on the House floor. For me, part of the appeal of Cannon’s story is that so much of it was captured in images: newspaper cartoons, photographs, campaign posters, and the rest. I thought you might enjoy seeing a few:

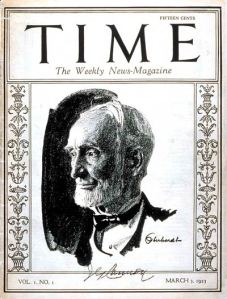

First, on the good side, when Cannon finally left Congress in 1923 as 87 year-old elder statesman, Time Magazine put his face on the cover of its first-ever edition.

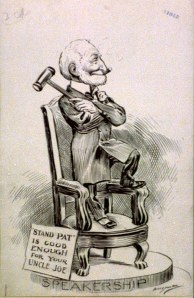

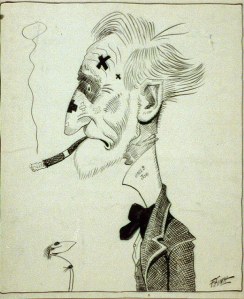

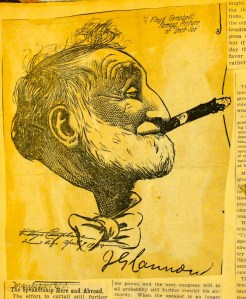

Here is Joe in his prime as autocratic House Speaker, around 1908. Cannon had a face that cartoonists loved: long, angular, big nose, big ears, white beard, and always the cigar in his teeth. He was tall, lanky, and twitchy, a whirl of motion who swung his awms when he spoke. Cannon was a penny-pinching conservative (“not one cent for scenery”) who believed in “standing pat” — his words — and used his power to block tariff reforms, labor laws, railroad regulation, and the whole Progressive agenda.

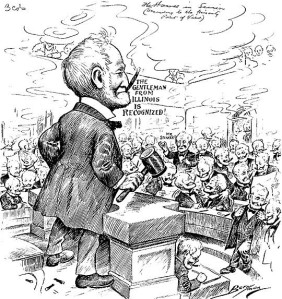

How powerful was he? In this front-page Washington Star cartoon by Clifford Berryman, Uncle Joe delights in presiding over a House consising of 390 little clones of himself.

The 1910 revolt to strip Cannon of his powers was a hugh public defeat and embarrassment. Here he is after the fight

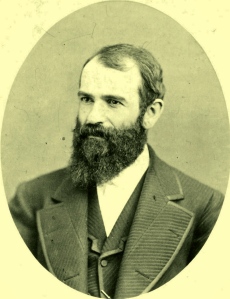

Finally, here is what Joe Cannon actually looked like in 1910. Cannon loved photos like this, with the trademark cigar, the big top havd, and a grin, his eyes betraying no douht about who”s the smarted pertson in the room.

"Uncle Joe" Cannon, Speaker of the House

November 16, 2010 at 5:05 pm | Posted in George W. Norris, John Boehner, Joseph G. Cannon, Nancy Pelosi, Progressive Movement, Theodore Roosevelt, William Howard Taft | Leave a comment These days, watching Nancy Pelosi and her bloodied, defeated Democrats in the US Congress prepare to surrender power to presumptive Speaker John Boehner and his new Republican majority, I can’t help but think of Joseph G. Cannon.

These days, watching Nancy Pelosi and her bloodied, defeated Democrats in the US Congress prepare to surrender power to presumptive Speaker John Boehner and his new Republican majority, I can’t help but think of Joseph G. Cannon.

Joe Cannon (R-Illinois) — everyone called him “Uncle Joe” — presided as Speaker of the House from 1903 to 1911, the height of Theodore Roosevelt’s era. When he left Congress in March 1923, he had served almost fifty years and been elected twenty-two times, a record back then. Time Magazine that month put his face on the cover of its first-ever edition. Tall, lanky, and outgoing, always a cigar in his teeth, quick with an off-color joke, a back-slapping poker player, Cannon received 58 votes for president of the United States at the 1908 Republican Convention and had his picture on two different brands of chewing tobacco. Above is a newspaper sketch of him from his glory days.

In most history books, Cannon is cast usually as villain, the arch-conservative on Capitol Hill who routinely blocked TR’s progressive ideas, “the vulgar old man who rules the National house” by one Chicago newspaper.

But Joe Cannon, the most autocratic leader ever to assume a chokehold over the National Legislature, also has the distinction of being the only House Speaker ever to be overthrown by his own members in open revolt, to his face, in public session. It was a rare public rebuke, and a signature victory for the then-rising Progressive Movement. Their anti-Cannon revolt, launched in March 1910 and led by young Nebraska congressman and future senator George W. Norris, played out in full public view, an unprecedented spectacle on the floor of Congress, a three-day parliamentary seige during which Cannon had to filibuster from the Speaker’s chair just to be heard. In the end, Norris and his Progressives succeeded in bringing down not just Cannon but also Republican President Willam Howard Taft and a generation of Washington oligarchs. (The snapshot below shows Cannon and Taft, in top hat, shortly before their respective defeats.)

The lesson for Nancy Pelosi and company, however, is not in Cannon’s defeat, but in his comeback. Joe Cannon was 74 years old at the time he was outsted from the Speaker’s chair in 1910. But rather then stewing in bitterness or self-doubt, he jumped right back into action. Cannon’s Illinois neighbors voted him back into Congress in 1914 where Cannon quickly rebuilt his friendships and reputation. He reinvented himself as elder statesman. And when time came for Congress to put names on its three House Office Buildings in Washington, D.C., they picked Cannon’s immediately.

The lesson for Nancy Pelosi and company, however, is not in Cannon’s defeat, but in his comeback. Joe Cannon was 74 years old at the time he was outsted from the Speaker’s chair in 1910. But rather then stewing in bitterness or self-doubt, he jumped right back into action. Cannon’s Illinois neighbors voted him back into Congress in 1914 where Cannon quickly rebuilt his friendships and reputation. He reinvented himself as elder statesman. And when time came for Congress to put names on its three House Office Buildings in Washington, D.C., they picked Cannon’s immediately.

So don’t fret, Democrats. Yes, there are second acts in American life, thanks in part to Uncle Joe. The pendulum will swing back. There will be another day.

Create a free website or blog at WordPress.com.

Entries and comments feeds.